A free webinar hosted by Woodhurst, OBConnect & Consectus

With the deadline for SD17 mandate to implement Confirmation of Payee (CoP) approaching, Woodhurst, OBConnect and Consectus are excited to share the dos and don'ts for implementation.

Join us for a discussion on the nuances of CoP implementation tailored specifically for Building Societies. We address the exact pain points of CoP implementation that ensures you have a seamless and efficient method to be compliant and reap the benefits.

Why attend?

This webinar offers an informal and open platform for dialogue, providing you with valuable insights into CoP implementation strategies. Join us as we discuss the roadmap for CoP implementation and ensure your organisation is prepared for the October 2024 deadline. Hear us expand on our joint approach to address the challenge of requirements, generic API provision and governance guidance.

The session will focus on:

- Understanding CoP Mandate - What is it? Why is it important? Implications for Building Societies?

- Benefits of CoP for both customers and lenders

- Technical challenges and how to overcome them

- Exploring CoP solutions with OBConnect and Consectus

- What the roadmap / project plan could look like

- Wider Benefits – Success stories etc

At the end of the session you will be able to:

- Understand the story behind CoP

- Understand the benefits it brings to your customers and your business

- Understand available technical solutions and how to implement

- Confidently start planning your CoP implementation

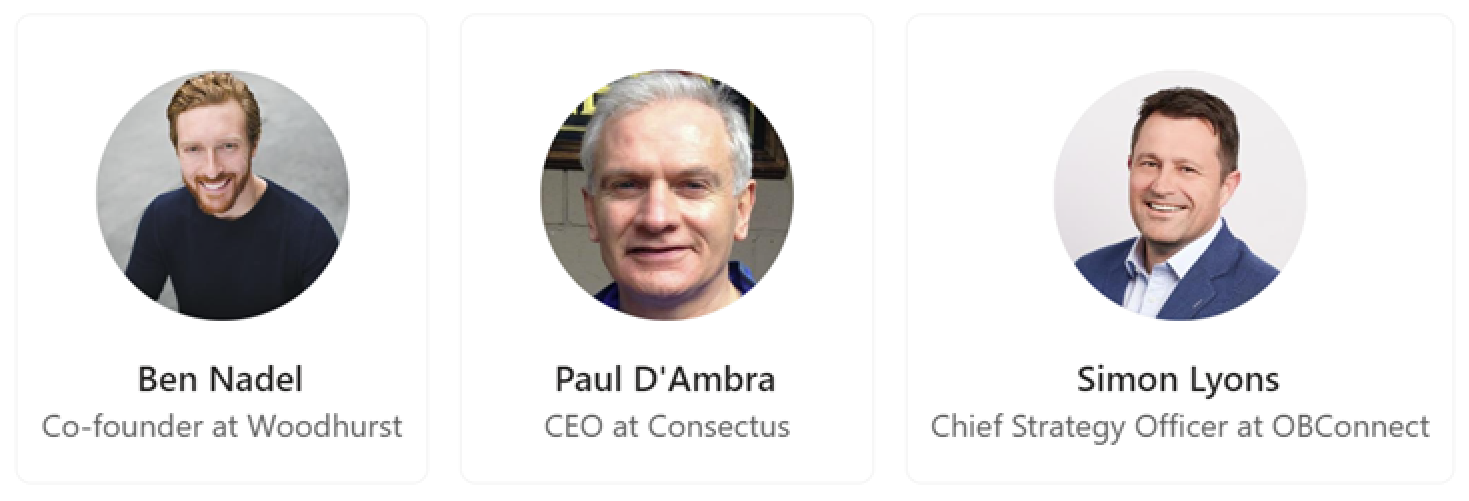

Speakers:

Date:

Date:

Monday, 6 November 2023

.png) Timings:

Timings:

12:00pm - 12:45pm

Cost:

Cost:

Free to attend

Contact:

Contact:

Please direct any enquiries to: alice.foley@woodhurst.com

- Consectus is a Fintech company aiming to bring class leading, innovative technology and products to the Building Society and small banking sectors in the UK. The products can then be implemented quickly leading to quick returns and savings in operational costs.

- OBConnect - At obconnect, we pride ourselves on being an all-in-one CoP and Open Banking provider. We serve as your comprehensive solution for all Open Banking needs, equipping Corporates, Banks, and Financial Institutions with the tools to thrive in the dynamic financial landscape.

- Woodhurst is an independently-minded management consultancy helping financial services organisations to create and enhance digital solutions.

Event Summary

- Monday, 6 November 2023

- 12:00 - 12:45

- Free to attend

.png?width=897&height=710&ext=.png)