Summary

National Savings & Investments (NS&I) currently has annual net financing targets set by the Chancellor in the Budget in March for the subsequent tax year. These funding targets can be disruptive of the retail savings market if they require NS&I to attract a substantial share of new savings and can make it difficult for both banks and building societies to manage their funding. The impact on the wider financial sector can be adverse. This short-termism, coupled with the tax-free status of NS&I products, can cause market disruption. This in turn has the potential to affect the amount of funding available for mortgage lending. Longer term guidance (5 years) is required to inform other deposit takers’ balance sheet planning.

This would bring NS&I into line with the forecasting approach of the Debt Management Office which publishes its projected gilt issuance on a rolling five year basis, linked to Budget forecasts, enabling market participants to plan accordingly.

What’s the issue?

Currently National Savings & Investments (NS&I) has annual net financing targets set by the Chancellor in the Budget in March for the subsequent tax year, starting in April. These funding targets can disrupt the retail savings market if they require NS&I to attract a substantial share of new savings at short notice and can make it difficult for building societies and banks to manage their funding.

NS&I is in the privileged position of being able to offer certain tax-free products which building societies and banks cannot offer and it is alone in being backed by a full Government guarantee for all its products. In setting the target for NS&I the Government has previously committed to consider the impact on other deposit takers although this has effectively been suspended in recent years, in light of abnormal market conditions. We consider it important that, going forward this be reinstated, so that NS&I is placed under an obligation to ensure its actions do not unfairly distort the cash savings market.

There is a strong case for the Treasury to go further and share NS&I’s funding projections on a rolling five year basis or for NS&I to do that themselves. This would mitigate the disruptive impact of the current approach and would provide medium term guidance about NS&I’s likely impact on the market, better fitting the planning horizons of private sector deposit takers. The projections would be helpful as guidance and would not be viewed as a commitment.

Why is it important?

In recent years NS&I’s forays into the savings market have resulted in the withdrawal of significant sums from savings accounts at building societies and banks, often over a short space of time with very little notice and opportunity to amend forward funding plans. Building societies may be particularly affected as they are required by law to raise a minimum of 50% of their funding in the form of retail savings.

Such levels of withdrawal have the potential to affect the amount of money that is available to lend on residential mortgages. With five year projections, building societies and other private sector lenders would have information that would facilitate better balance sheet planning, which in turn would aid more consistent lending to new homeowners and families looking for job mobility or to move up the housing ladder.

In the case of fixed term bonds, when the products mature there is conversely a risk that the market is flooded with liquidity. Having indicative guidance further out on NS&I’s intentions will help other businesses to plan.

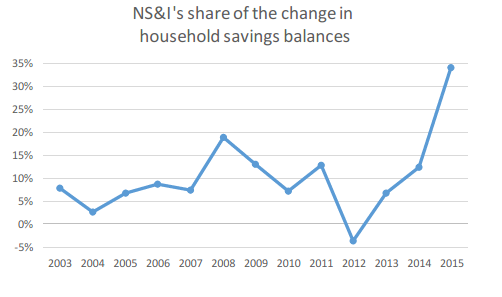

One recent example is the 65+ bonds offered by NS&I at the start of 2015 which attracted £13.7 billion from savers. The graph below shows the distortion to the market caused by NS&I’s product offering. Its 34% market share for 2015 exceeds the crisis years when it was seen as a safe haven, and far exceeds its share of outstanding deposit balances (9%).

We expect that the 65+ bonds were a one-off aimed at supporting a certain group of savers, and we would strongly object to similar bonds with rates much higher than those possible in the market becoming a permanent feature.

What needs to change?

As NS&I has advantages not available to those in the wider marketplace, we are calling for greater clarity about their longer term plans, so that others can react accordingly and so that the functioning of the market is not excessively disrupted.

We are calling for either the Chancellor or NS&I to set out a projected net financing profile for a horizon of five years to enable the impact of its financing requirements on the general retail savings market to be assessed by other deposit takers.

Other examples of such long term forecasting already exist. The Debt Management Office publishes its projected gilt issuance for the next five years, based on Budget forecasts, enabling market participants to plan accordingly.