- The Royal Institution of Chartered Surveyors (RICS), The Building Societies Association (BSA), and UK Finance have today agreed a new industry-wide valuation process which will help people buy and sell homes and re-mortgage in buildings above 18 metres (six storeys).

- The industry is also encouraging the owners of these buildings to proactively pursue independent testing of external wall materials to safely speed up the process for buyers and sellers.

RICS, the BSA and UK Finance have agreed a new industry-wide process – to be used by valuers, lenders, building owners and fire safety experts – in the valuation of high-rise properties.

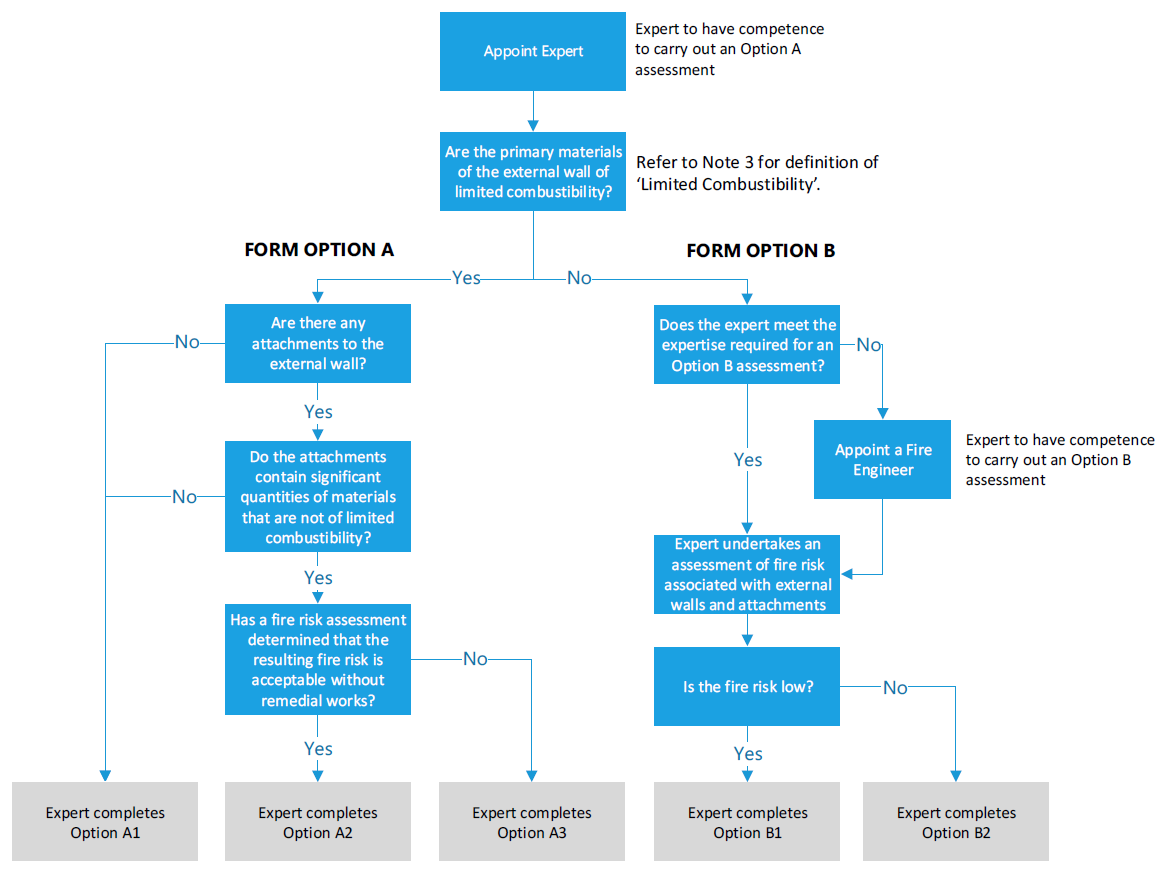

The new External Wall Fire Review process will require a fire safety assessment to be conducted by a suitably qualified and competent professional delivering assurance for lenders, valuers, residents, buyers and sellers. The Review has been developed through extensive consultation with a wide range of stakeholders including fire engineers, lenders, valuers, and other cross industry representatives. Only one assessment will be needed for each building and this will be valid for five years.

Charlie Blagbrough, BSA Policy Manager said:

“This new industry process is the result of substantial consultation across the housing industry and Government. It takes into account the range of external wall materials that are in use on apartment buildings and will now be used industry-wide. Ensuring the safety and security of those selling, purchasing and living in high-rise homes remains paramount. However, we expect that this new process will instil confidence to enable surveyors to value, lenders to lend, and ultimately keep the high-rise property market flowing.”

John Baguley, RICS Tangible Assets Valuation Director said:

“RICS have worked with stakeholders across industry and MHCLG, to jointly create a standardised approach between valuers and lenders that will ease current issues in the high rise property market. To unclog areas of the market, a qualified and experienced fire safety expert will be appointed by the building owner to provide a report on the buildings cladding, and associated wall system, as an additional part of the valuation process. This will ensure safety, and will also ultimately allow the high rise property market to function properly.”

Matthew Jupp, UK Finance Policy Manager said:

“The independent valuation has a key role to play in the home-buying process, helping to deliver assurance to all parties involved that a property is both safe and secure. The External Wall Fire Review is an industry-wide initiative that will further support the buying and selling of homes in this section of the market.”

Notes to editors:

Note 1

Process as follows:

- Valuer instructed by lender

- Valuer checks whether building has EWS certificate

- If yes – acts depending on certificate content

- If no – the following process starts (Note: it is the building owner who appoints the expert)

Note 2

Earlier this year, the government announced it’s planning to bring forward legislation to implement new building safety standards to provide further reassurance in the high-rise property market.

About RICS:

We are RICS. Everything we do is designed to effect positive change in the built and natural environments. Through our respected global standards, leading professional progression and our trusted data and insight, we promote and enforce the highest professional standards in the development and management of land, real estate, construction and infrastructure.

Our work with others provides a foundation for confident markets, pioneers better places to live and work and is a force for positive social impact.

About UK Finance:

UK Finance is the collective voice for the banking and finance industry. Representing more than 250 firms across the industry, we act to enhance competitiveness, support customers and facilitate innovation.

About the BSA:

The Building Societies Association (BSA) is the voice for buildings societies in the UK. It has all 43 building societies as members, plus 6 of the largest credit unions. All BSA Members are mutuals – owned by their customers. The role of the BSA is to both support and champion the sector.

|

RICS Rebecca Hunt Head of Media and Communications Tel: 0207 334 3831 |

BSA Amy McCluskey Press & Publications Officer Tel: 0207 520 5927 |

UK Finance Natalie Bruce Manager, Press Office, UK Finance natalie.bruce@ukfinance.org.uk Tel: 020 3934 4392 |