At Nationwide, we believe that financial education is a cornerstone for building a secure and prosperous future. That's why we are delighted with the success of our recently relaunched Money Lessons programme. Designed to support teachers and students across Key Stages 2 and 3, this initiative aims to make financial literacy accessible, engaging, and inclusive for all.

At Nationwide, we believe that financial education is a cornerstone for building a secure and prosperous future. That's why we are delighted with the success of our recently relaunched Money Lessons programme. Designed to support teachers and students across Key Stages 2 and 3, this initiative aims to make financial literacy accessible, engaging, and inclusive for all.

A Fresh Start with Renewed Focus

Relaunched at the end of January, the Money Lessons programme has been revamped with a key focus on supporting teachers in creating comprehensive lessons, resources, and plans that align with the PSHE national curriculum. Our goal is to empower educators to deliver high-quality financial education that resonates with students aged 7 to 14. By providing structured lesson plans, interactive activities, and engaging presentations, we aim to make learning about money fun, informative and accessible for all.

Inclusive Education for All

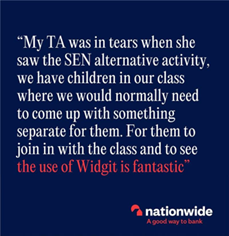

One of the standout features of the Money Lessons programme is its commitment to inclusivity. We understand that every student learns differently, and we've worked hard to ensure that our materials are accessible to everyone, including children with Special Educational Needs (SEN) in mainstream school settings. Integrating Widgit into the classroom activities has really helped to support all pupils in the classroom setting.

One of the standout features of the Money Lessons programme is its commitment to inclusivity. We understand that every student learns differently, and we've worked hard to ensure that our materials are accessible to everyone, including children with Special Educational Needs (SEN) in mainstream school settings. Integrating Widgit into the classroom activities has really helped to support all pupils in the classroom setting.

Impact

In just 10 weeks, the Money Lessons programme has made a significant impact. Through a combination of colleague-led and teacher-led lessons, we have delivered over 1,800 sessions, reaching more than 50,000 pupils across the United Kingdom. This reach highlights the enthusiasm and dedication of our colleagues but, more importantly, the demand and need from schools for support from our industry to help deliver crucial financial education interventions.

Why Financial Education Matters

Financial literacy is more than just understanding how to manage money; it's about equipping young people with the skills and confidence to make informed decisions that will benefit them throughout their lives. Studies have shown that children who receive financial education are more likely to save regularly, have a bank account, and feel confident managing their money.

By integrating financial education into the school curriculum, we are helping to build a generation of financially savvy individuals who can navigate the complexities of the modern financial landscape.

Making a Difference

We are incredibly proud of the progress we've made so far, but we know there's still much work to be done. We invite teachers, parents, and community members to join us in our mission to provide high-quality financial education to every child in the UK. Together, we can make a lasting impact on the lives of young people and help them build a brighter future.

For more information about the Money Lessons programme and to access our resources, please visit www.nationwide.co.uk/moneylessons.

.png?width=897&height=710&ext=.png)

-v2.png?width=896&height=634&ext=.png)

.png?width=896&height=634&ext=.png)