This article was first published in the Winter edition of Society Matters magazine (Dec 2023).

Capitalism tends to destroy its two sources of wealth: nature and human beings” is a saying often attributed to Karl Marx. Apparently he was not that pithy, but the sentiment is close to what he did write in rather less penetrable terms.

Capitalism tends to destroy its two sources of wealth: nature and human beings” is a saying often attributed to Karl Marx. Apparently he was not that pithy, but the sentiment is close to what he did write in rather less penetrable terms.

Hearing that quote at a recent credit union conference got me wondering, “what about mutuals?” As part of its definition of mutuality, ChatGPT concludes that, in general, mutuality describes the positive, beneficial relationship between different entities or people. We often talk of mutuality as capitalism with a social purpose or social capitalism – making profits or surpluses from our businesses to reinvest in our communities and in the future of our building societies and credit unions for the benefit of current and future generations of members. Implicit in that statement is that we somehow make good profits, that fulfilling our purposes of providing safe homes for members’ savings and savings for their homes or other needs justifies our business models and strategies. In meeting the needs of members and society, not external shareholders, we are not guilty of destroying those two sources of wealth. By and large we would, I suspect, all like to think that is true.

With the next general election no more than thirteen months away, the newly published Co-operatives and Mutuals Prospectus (Nov 2023) picks up a theme that we have been talking about since Building Back Better was a short lived government campaign as the Covid pandemic started to recede. Along with our partners, we are calling for a new collaboration between co-operative and mutual businesses, government and society. Whatever the outcome of the election, we want an incoming government to play its part by:

- Designing an environment which supports the growth of co-operatives and mutuals;

- Delivering an overarching legislative and regulatory framework to provide a level playing field for co-operatives and mutuals; and

- Creating and preserving capital to support new and growing co-operatives and mutuals.

For our part, as the wider community of cooperative and mutual businesses, in return we commit to:

- Contributing positively to strengthening UK economic resilience through our diversity of ownership model, focus on long-term steady growth and stewardship;

- Contributing to economic growth, job creation, investment in UK businesses and property, home ownership and household financial resilience; and

- Returning value to our members and communities today and in the future.

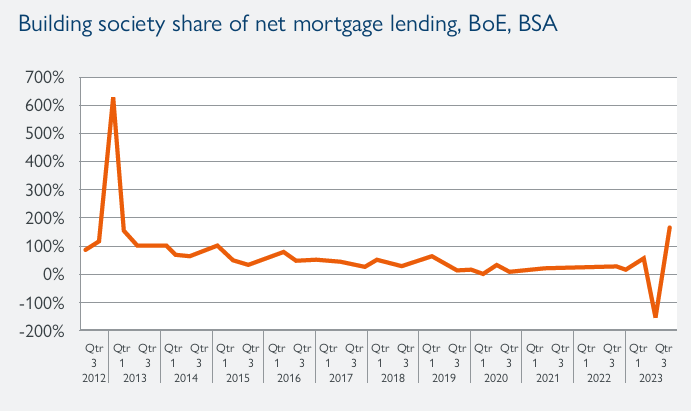

What do we really mean by all that? Picking out the elements that particularly relate to building societies and credit unions gives me an opportunity to share two of my current favourite charts. Looking back to the days after the 2008 financial crisis, it was building societies who led the way, even dominated, the mortgage market. Between 2012 and /2019 our share of the market grew from 20% to 23% and has held steady since then until the current period of turmoil, when we have started taking market share again:

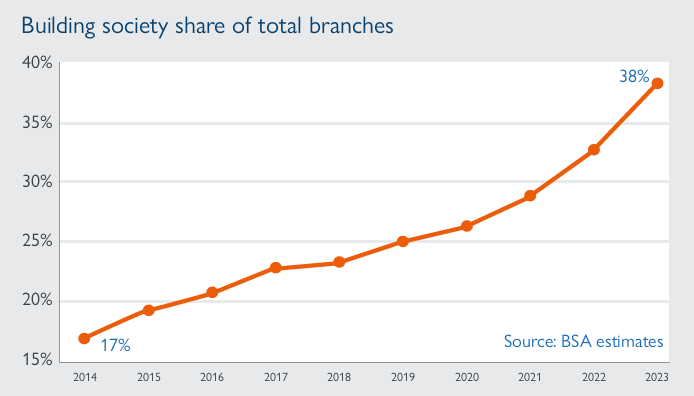

While the UK’s retail banks appear intent on closing their branch networks down as fast as they can get away with, despite all the efforts of the Financial Conduct Authority, building societies and credit unions have maintained their commitment to high streets and communities up and down the country. Our sector’s share of branch footprint has increased from 17% to 38% since 2014 and seems likely to continue on that trajectory:

That determination to maintain branch networks as visible and tangible commitments to our communities is not just leading to brilliant mutual innovation about the purpose of branches. More and more boards also appear to be focused on renewing the fundamental purpose of their building societies and credit unions, embedding their community activities more deeply in their strategies and thinking far more widely about what matters to their members. Some of the feedback we hear may sound surprising – from AGMs at which building society members applauded their society for making generous cost of living payments to lower paid staff last winter, to plaudits from those same members for societies who have gone out of their way to recruit school and college leavers from their most deprived communities – providing real job and career opportunities to young people most at risk of missing out.

Post pandemic, there has been quite a lot of commentary that this is the time for truly purpose driven businesses to thrive; that society is becoming increasingly tired of exploitation by large corporates overlyfocused on maximising shareholder value, and too often short term shareholder value at that. In that spirit, our most recent strategy update for the BSA itself saw calls from members that we should do more to amplify the messages, good works and achievements of the sector. After years of caution post financial crisis, and a decade long campaign by the BSA for government and regulators to recognise the importance of a properly diverse UK financial services sector with financial mutuals at its heart, its seems that the sector is getting its mojo back. No hubris, no complacency, but a steady and well found assurance that our long term, steady growth models provide a crucial underpin to the country’s ambitions for economic growth, for creating a fairer society, and a more financially resilient society.

So as we come to the end of 2023 and look forward to the new year, we should do so with renewed confidence. Perhaps we should also all challenge ourselves about what more we can do to achieve and amplify our purpose, how we can go further in supporting our members and communities in ways that our shareholder owned competitors can’t conceive, how we stand out even more for all the right reasons. In essence, how we play our part in fulfilling that covenant between co-operative and mutual business, government and society.

Find out more:

You can follow Robin on Linkedin

.png?width=897&height=710&ext=.png)

-v2.png?width=896&height=634&ext=.png)

.png?width=896&height=634&ext=.png)